KKR 2Q24 Earnings | Thoughts on Great Businesses

“A good business tends to throw up one easy decision after another. While a bad business, well…” — Charlie Munger

“If you have a great business, and you’re thinking of selling, you should ask: is the business getting better?” — Chuck Akre, Founder & Chairman, Akre Capital Management. It isn’t just about price vs. your modeled valuation.

~15 min read. Light on charts, heavy on words today. No picture books for you guys.

[Addendum: as of Aug 5th, global equity markets continue to dive shortly after I wrote this. Not sure I feel like discussing. Essentially, the Fed didn’t lower interest rates as the market hoped, then a “bad” US jobs report came out. The market’s narrative has shifted sharply to a potential recession near-term. A lot of fundamental data are _decent_, but deteriorating. I’ve pointed out repeatedly that our “starting point” for a potential recession seems to be quite good. I still think most of the mass of the “macroeconomic probability distribution” for the next 1-2 years lies within a range of mild recession to continued expansion. I wouldn’t bother to pin a on any outcome. Most importantly, I stress-test my holdings periodically and already know they have more than enough staying power even in a severe downturn. GM our most cyclical holding. It holds enough excess cash (plus a very large undrawn credit revolver) that it can handing its working capital unwinding while profitability moves to a loss position, and while continuing to invest reasonably heavily in R&D to fund upcoming products.]

Not much has changed fundamentally about our alt. asset managers, so this update will be short & simple. We’ll reiterate the thesis, go over changes in certain KPIs (key performance indicators) and provide a basic valuation update, talk recent developments, and conclude.

If you want to know more about KKR, Brookfield, and the alt. asset management industry, head over to the posts linked below! Otherwise, read on for the update.

Restating The Thesis

(Feel free to skip if this is refresher for you and you know why I own Brookfield and KKR.)

Recall our thesis on KKR and Brookfield:

If you add up the world’s institutional money (sovereign wealth funds, pensions, large family offices, insurers, etc.), only 25-29% is allocated to alternative investment asset classes today. That’s private equity (PE), private credit (PC), infrastructure, and so on. That’s KKR’s/Brookfield’s/competitors’ Assets Under Management (AUM). The remaining 75% of clients’ assets is <50% bonds, <25% stocks, and some immaterial allocations.

These investors’ portfolios can be made more “efficient”1 by adding more alternative investments. PE is the most mature, but other asset classes like “real” assets (infrastructure, renewable energy, and real estate) and PC are newer, offer significant value and diversification benefit for client, and are underpenetrated in their portfolios. Consider that many infrastructure assets are long-term contractual businesses with stable volumes/revenues, and the ability to raise price annually, and so often make more sense to own than long-term corporate bonds.

The most sophisticated investors who have been doing this the longest (25 yrs), such as the Canada Pension Plan Investment Board and the Yale endowment, are already more than 50% allocated to private/alternative assets, and are a good goalpost for where the industry’s clients are headed to overall. That implies industry AUM doubles next 10-20 years, from “share of wallet” gains among institutional clients alone. Those clients’ portfolios are also growing from their investment returns2, ~4%+ per year, adding a further tailwind. That’s 10%+/year industry growth for KKR, Brookfield, etc., for a long time.

Within that context, clients want to do more business with the leading, well-established managers who offer a one-stop-shop platform where they can sell you a private credit fund, an infrastructure fund, and so on, where the client only needs to maintain relationships with a few high-performing managers. Leaders like KKR spent the last 10-15 years assembling this broad base of products. Others, like ONEX and many more, tried and didn’t succeed. There are now only ~10 ultra-scaled managers with this kind of product set and with global reach (marketing/distribution/relationships). So long as their products generate good investment performance, they are, and will continue to, take market share from the industry’s 500+ other competitors, setting the stage for >10% growth for the leaders.

On top of this, the “retail” market is virtually untapped at only 5-10% penetration, and is much larger than the institutional market, with USD >200 trillion in global wealth among high-net-worth individuals. This is another multi-decade tailwind, but only for the scaled players. This is because they have to distribute their products through large wealth managers like Morgan Stanley, Fidelity, UBS, Capital Group, etc., who already have funds, investment advisors, and millions of relationships with retirees, savers, and other individual investors. These wealth management houses need a large money manager who has the scale to move the needle for their clients, who has a strong performance record and brand name (to avoid “career risk”) and who has a broad product set. Last, the Morgan Stanleys and UBSs of the world will only work with a select few managers each.

All but the last bullet point were fleshed out a report I wrote myself ~5 years ago when buying KKR at ~$33/sh. The last point I knew of but only mentioned in passing. My thesis has broadly played out, and KKR’s intrinsic value growth has outperformed my base case.

Yes, KKR now manages $600 billion AUM, but it’s still a tiny piece of the market and will continue growing ~10% annually for years. Meantime, it’ll continue earning attractive returns on capital because

The industry structure is now a locked-in oligopoly of competitors who don’t compete on price because (a) there’s so much new pie for everyone to eat every year, and (b) KKR and peers generally offer very strong fund returns to clients, more than justifying the price charged.

The company requires little capital investment to grow the asset management businesses, which are just offices full of smart people.

Somehow the market was fine selling this business to me at 8x its earning power twice, at ~$33 in 2019/20, and at $45-55 in 2022/23, because at the time it was concerned with short-term issues like a lack of carried interest earnings.

The stock’s now $124 and can earn $6-7 per share (18x). That $6-7 is very roughly:

Up to $4 from the asset manager, 60%+ of which is fees, and the rest carried interest

$1.33 from the insurer, Global Atlantic (GA)

$1.10 from principal investments in KKR’s funds alongside clients, and

$0.50-1 in a few years from in a few years certain long-term investments directly on its balance sheet.

I don’t update my model or these values constantly, but I keep abreast of what’s going on constantly.

KPIs & 2Q24 Performance

Fund performance, carry: rolling performance is improving. In 2Q23, KKR’s PE portfolio returned 2% over the prior 12 months (LTM), and its real estate (RE) investments collectively lost 11%. Today, LTM performance is 18% and 3% in those portfolios, respectively. This is partly from:

Strong equity market performance, as PE investments are partly valued based on publicly-traded “comparable” companies, like how your real estate broker compares your house to others on the street when selling), and

Performance of those PE and RE holdings themselves, as KKR is well-positioned in RE like logistics warehouses, data centers, etc., where rents are rising swiftly. It mostly avoided office RE. In PE, I know KKR tends to buy stable businesses where there are usually good revenue opportunities, so the companies in its PE funds tend to do well and grow intrinsic value regardless of the times.

Infrastructure (+17%) and credit funds (+12%) continue to do well. Over 75% of carry-eligible AUM is above cost and accruing carry for us as performance improves. Our balance sheet investments also returned 14% gross. The underlying businesses KKR owns for us (directly and indirectly) saw their revenues and cash flow rise 14% and 12%, respectively.

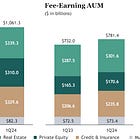

Fundraising, AUM, fees: KKR raised ~$70 billion in 2023. In the first half of 2024, it’s already raised $63 billion, on track to surpass the 2021 banner year (~$120 billion). AUM is now $601 billion, up 16% LTM. This drove +12%3 fee revenues and +18%4 fee-related earnings. Most AUM growth is PC (asset-backed finance, direct lending, etc.) and real assets (real estate, energy transition, and infrastructure).

Fully half of fee-paying AUM is now “perpetual.” That’s:

GA, the insurance subsidiary’s balance sheet.

“Capital recycling” via separately managed account agreements with clients.

Perpetual fund products like traded and non-traded investment funds.

Consider: LTM, GA brought in $50 billion in new annuities and insurance policies. The majority of that money finds its way into KKR’s PC and other investment funds as GA invests policyholders’ money. It’s an excellent channel for AUM growth.

KKR’s still seeing relatively high demand in non-PE equity investments like infrastructure, energy transition, etc., and high demand in PC. Many clients are below their target allocations5 in these areas. PE is more mature and seeing less incremental demand. This has been the story for years.

GA: is also still in the process of rotating capital from its legacy corporate bond portfolio into PC and other KKR funds. This will boost the returns of GA’s overall investment portfolio, which in turn will grow the “spread between GA’s investment returns (assets) and the cost of its insurance policies (liabilities), increasing GA’s return on equity (ROE). Currently, its ROE is depressed at ~12% and should migrate to 15% in the near future as KKR executes.

Looking forward nearer-term:

If the Fed begins to cut rates (which it’s now signaling) and indeed engineers a soft landing, I would expect sustained or even accelerated growth at KKR. A soft landing would mean a growing economy and lower interest rates, both of which support asset prices and profit growth.

Already, capital markets activity is up across the economy. Major banks have been reporting ~40% growth in their investment banking divisions for 6 months+, meaning corporations are doing more M&A and more financing deals. KKR already sees leveraged credit issuance up 100% vs. last yr. It' also sees pent-up demand for PE and other deals as sellers were reluctant to transact at lower prices when interest rates first rose and depressed asset prices.

In the last 5-10 years, KKR has also adopted a more “linear” approach to putting client’s money to work, and did not deploy as much capital in 2021’s ebullient market. As a result, it has more dry powder today. If conditions deteriorate, that money would be put to work in a depressed market and would thus very likely go on to earn excellent returns for clients (and carried interest for us). It’s a bit much to detail everything, but KKR has numerous opportunities to put capital to work today, especially in infrastructure, RE, and PC.

Institutional investors pay far more attention to forward expected returns than recent performance. The S&P 500 and other indexes trade near all-time high multiples, while many private markets assets are cheaper and have higher expected returns. It’s great that for 15 years we have had one of the greatest bull markets of all time, but that performance has been partly driven by an increase in multiples — the prices people have been willing to pay for future cash flows — and only partly driven by improvements in the underlying companies’ cash flows themselves. Multiples will not rationally rise forever. And there are reasons they may eventually fall. While many retail investors are excited, the potential for lower future returns is pressuring institutions to continue allocating away from stocks in favor of assets like infrastructure, RE, PC, etc., where forward returns are more attractive. On the bond side of their portfolios, with so-so interest rates that may even fall from here, institutions are also incentivized to replace bonds with better alternatives like PC and infrastructure. It’s a good setup for good underlying performance at KKR and Brookfield.

Markets aside, and back to the economy: if the economy does poorly, we could be in for 2-3 years of slow AUM growth and no carried-interest-based earnings, but this outcome is more than covered by the price we paid at $45-55, and we won’t lose money. If the stock tanks then, we will probably add.6 You have to remember that KKR typically buys “good-to-great” businesses, where the the business is already good but has things like revenue opportunities it can exploit (e.g., introducing or repositioning products). After a recession, those businesses will still be larger than today, and so more valuable. Thus, our carried interest and our balance sheet are only being delayed.

Recent Developments

KKR continues to capture opportunities in front of it. Two noteworthy mentions.

First, there is demand for a “new” asset class: insurance blocks. This is a little complicated, but think of it kind of like the mortgage or auto loan securitizations we’ve talked about with Bank of America or Ally.

KKR’s clients would co-invest alongside GA, underwriting blocks of insurance policies. In a way, they would put up some of the regulatory capital GA does when it writes new business. This would mean GA could grow in a more “capital efficient” way, wherein it doesn’t use as much of its own balance sheet to grow its book of business. GA would still take a fee (a profit stream) for its admin and marketing work. Maybe you can see how GA’s returns on capital could rise this way while KKR’s AUM would get another avenue for growth.

Second, in May, KKR built a relationship with Capital Group, one of the largest retail money managers in the world with $2.9 trillion in AUM and 67 million end clients. They agreed to develop fund products for the retail market. The idea follows the general industry trend of combining a mostly-illiquid alt. asset portfolio (say 70%) with a liquid public markets portfolio of stocks and/or bonds (say 30%) to provide individual investors with liquidity while giving them exposure to better-performing private markets investments.

This isn’t the first such relationship and won’t be the last, as KKR continues to go after the $200T global high net worth market. Even before this deal, KKR has already been raising $900 million/month (a 1.8%/yr AUM growth tailwind and up from $500mill/mo) from individuals. Importantly, these flows have come from high-net-worth investors (accredited investors), whereas Capital Group’s investor base is mainly the mass-affluent market (who aren’t accredited investors), who make up maybe ~95% of the retail market in terms of the number of clients. So, this opens up an entirely new market segment for KKR.

“…the more interesting point here is really that long-term secular opportunity. Mass affluent individual investors have not had an easy way to access alts … We do expect an opportunity for trillions of dollars of assets to flow into these products. And given our brand, our track record, and the investments we've made in distribution and marketing, it just feels like we're really well positioned to continue to be a winner.” - Craig Larson, Partner, KKR

Conclusions:

I see no reason to sell. Although the stock’s not cheap enough to add to vs. other opportunities, the thesis is working well, the stock isn’t obviously overvalued, and the business itself is improving, with a wider moat and more growth opportunities ahead than before. KKR earns a ~17% aggregate ROE with ~6-10% aggregate growth (BN’s similar) and is reasonably worth ~26x if the thesis continues to play out as it has and as the evidence says it should. The stock’s firmly in “green light” territory as far as investment theses go.

If you’re enjoying the read, please consider sharing with the link below:

KKR, Chuck Akre, and Some Investing Philosophy:

The quotes at the top of posts are usually relevant. If you think about this company and you’ve read all my posts, you might conclude like I did: this business is getting better.

10 years ago, KKR’s infrastructure business was new, its first fund vintage seeded mostly with its own money. Now it’s one of the world’s largest infrastructure investors and is earning very attractive returns for clients; the fee and carry rates on those funds went up as they were proved out. KKR did the same with other fund products, rounding out its portfolio. There’s little it can’t sell to clients today. Consider: it made forays into Japan and is now one of Japan’s larger RE investors. With new Asian infrastructure and RE funds, it will soon be one of Asia’s largest real assets and private equity investors. It’s now working on this with credit investments. The list goes on.

Many competitors had been trying to do this and become a one-stop-shop global platform, but haven’t. TPG was once one of the largest alt. asset managers in the world and is only just now building a credit business through acquisition. It’s still missing other stuff that will take 15 years to build even if it succeeds. ONEX bought Gluskin Sheff (GS+A) to cross-sell private markets products to GS+A’s high-net worth-clients, and failed.

In many ways, the race is now lost, and most of the runway ahead will be left to a small number of players like KKR.

Even with new investment opportunities, like the energy transition that’s come into vogue over the last 5 years, or the huge investments needed to support IT infrastructure for the cloud & AI transitions, who is best positioned to bring these products to market? Some new guy that no institutional investor knows? Or KKR or Brookfield with their huge client bases, and mind share (i.e., that clients already do business with them for other asset classes, and have had good results there)? Exactly. It will be KKR, Brookfield, Apollo, Blackstone, and Friends, who will still get the lion’s share, even of some new “next big thing” that comes along, and take client “wallet share” that way.

KKR also found life/annuity insurer Global Atlantic and bought most of the company for book value. The business was already doing a 15% ROE. So not only was the deal attractive in its own right, but KKR is still in the process of bringing more than $150 billion in AUM from GA under its umbrella — to say nothing of new policies that GA underwrites and gives to KKR to invest. More of KKR’s AUM growth is in its own control, is perpetual, and can’t be taken away in a downturn.

Signs point to this business being better than it was 5 years ago, and likely better in 5 years than today, with nobody new coming in to eat the winners’ pie.

Why be so eager to sell and buy a new stock? I’d have to understand what I was buying at least as good as I understand KKR. I’d have to estimate the probabilities and outcomes at least as well as I can for KKR. I’d need to be quite sure I’m getting much more value for my money if I make the switch. Otherwise, shouldn’t I sit still and let this winner ride for years?

That’s what Chuck Akre meant.

I know I promised a GM update, but you get this today. My Substack’s still free, so deal with it!!! >:)

Actually, the GM post is mostly done and will be out in due course.

Chat soon.

Chris

That’s the industry term for better returns per unit of risk, while maintaining or increasing diversification.

Net of what they pay out. For example, the Yale endowment might be making 10% returns annually or something, but it is paying out part of the endowment each year to fund some of the University’s costs. Pensions do the same, paying benefits out to retirees (while collecting contributions from those who are working.

Credit funds have lower fee rates (~0.45% vs. 1.0%+ in infrastructure, private equity, etc.), so revenues will grow slower than AUM.

Note that some of the fees come from capital markets transaction fees, which is basically KKR’s own internal investment bank which charges for the deals instead of paying guys like JPMorgan to do it, and thus KKR captures more of the industry’s economics.

Basically, each year, most large institutional investors’ CIOs sit down with the investment committee or portfolio management committee, and decide on their “strategic asset allocation” which is too long to describe here. After that, they come up with what percentage of the portfolio they believe should be allocated to each asset class. To be below the target allocation in things like PC means that they will speak to KKR, Brookfield, etc., about allocating even more to those guys’ funds.

Assuming the reason is for something other than “my long-term global asset allocation thesis above is no longer valid”; and I don’t have a better idea than KKR at the time.