~5-8 min read. Great for bathroom breaks.

For transparency, I’ve increased my positions in ELV and UNH to 7.5% and 5%, respectively. It’s possible we may own more, but I might be hitting the limits of what I can learn in a short time vs. how much certainty I can obtain, so I may leave them now depending on what I find in the next few weeks.

In an upcoming post you’ll receive the industry analysis for both companies. After that will be ELV-specific work, then UNH in a third post.

To source funds, we mainly reduced our positions in KKR, GM, and Ally. In my mother’s accounts, I sold these plus a tenth of her 16% weight in Berkshire. We’d also just bought a 2% position in a Canadian small cap called Versabank, which I sold for these as well because the quantitative risk/reward is better and because I feel I have a better sense of the qualitative value proposition and its durability over time. I.e., the numbers are better, and I have higher conviction I’m right. As they say in Russian mafia movies: iz notting purrsonal, iz jus’ business.

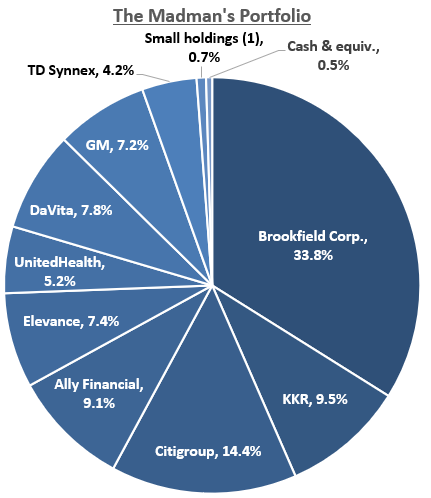

My portfolio looks like this today:

I would think of our alt. asset managers and our healthcare MCOs on a combined basis. Brookfield + KKR = 43.3%, Elevance + UnitedHealth = 12.6%. They share similar competitive positions and will benefit from similar industry tailwinds, so the thesis is more industry-level than company-specific. However, I think it’s fair for you to assume we own more Brookfield than KKR because we like & understand it more.

Similarly, thus far I feel I understand Elevance better than UNH. The main reason is Elevance is essentially “catching up” to UNH as it vertically integrates into providing healthcare, analytics, and pharmacy benefits. By contrast, United is growing into “white space,” which I’m still working on and is tougher to see. Deductive logic is easier than inductive logic: with ELV, you’re doing more “reasoning by comparison” whereas with UNH it’s more “reasoning from first principles.”

A couple examples of what I mean:

Elevance is growing its own PBM, CarelonRx, from scratch. But, it has 45 million plan members, and ~110 million in the Blue Cross Blue Shield (BCBS) ecosystem. CarelonRx doesn’t disclose its membership base, but you can kind of see it’s underpenetrated when you compare the revenue dollars or the number of scripts written per member in the total member base between CarelonRx and UNH’s OptumRx. It’s clear from the comparison that there’s lots of opportunity for ELV to keep cross-selling PBM services by bundling it into ELV’s insurance contracts as they come up for re-bid every few years. ELV cancelled its contract with Express Scripts (owned by Cigna) years ago, currently runs on top of Caremark’s (CVS) back-office, but does its own contracting and other activities in-house now. PBM is a tremendous business with negative tangible equity, so it’s also accretive to ELV’s returns on capital as ELV executes. This is a fantastic use of management’s time, is low-hanging fruit, and will significantly grow profits. It also requires no invested capital to grow, so it’s highly accretive to ELV’s returns on capital. Win win win.

UNH is ~5+ years ahead. OptumRx is already mature and penetrated, with maybe a small amount of market share opportunity ahead. UNH is still vertically integrating into being a provider, though, in Optum Health. It’s mostly via M&A. Where it makes sense, they buy chains of clinics and specialty medical centers like surgery, medical imagine, drug infusion, etc. (but not hospitals). After acquiring, they shift them onto value-based and risk-based contracts with UnitedHealth and the other MCOs the providers’ serve. They use UNH’s massive insurance & other data trove — of which UNH has more than anyone else in the industry because of their ~50 million member scale — to determine how to influence patient and physician behavior, etc. This then lets them reduce patients’ costs by making them healthier. Contracts are structured such that Optum Health captures a portion of the savings as profit. I’m less informed here, but so far I get the strong sense there’s huge runway ahead. Probably <35% of providers’ volumes across the industry are structured under this type of risk-based contract. Optum Health is a $105 billion revenue piece of a $5 trillion US health expenditure pie (2.1%). There’s no one to compare to because UNH is in the lead, but we can look at the total market instead and think about why they can take a bigger piece of the pie, and what profit can be captured as they do so.

UNH also looks like a 2x in that this is a $300 per share business that by my math will be earning $30+ per share in just 2-5 years, while still growing >5% annually at that time and earning the industry’s highest returns on capital (infinity — as there is actually no tangible equity capital in the business)

The hawk-eyed among you might notice TD Synnex (SNX) in the portfolio. I’m sorry I haven’t posted this yet, it’s been on my to-do list. I bought it in the spring. It’s a painfully simple business. They are the scale leader in distribution of finished IT hardware products. That’s PCs, smartphones, enterprise cloud servers, routers/switches, conferencing equipment & cabling, certain software, and thousands of other items including customer-made and ready-for-use server racks for cloud & AI datacenters. It’s a low-mid-single digit growth industry where SNX is the leader. There is only similarly-sized competitors, and the rest of the market is fragmented. If you have the most scale, you get better distribution efficiency and such and you can get better sales incentives from the IT vendors because you have the breadth to help them quickly access a huge global market (SNX has over 100,000 customers, mainly IT consultants and systems integrators of all sizes — so it’s really easy to help a new vendor pitch new software and equipment for the customers and for the end-users). I also like Patrick Zammit and his team and think they are smart day-to-day operators. They’re good at thinking about the value proposition and working backward from what both the vendors need from them (market access) and what the IT consultants/retailers need (really good solutions options & short lead times). SNX has global teams of merchant buyers where — like Costco or Walmart’s merchant buyers — all they do is go around talking to large and even very small start-up vendors to look for new and useful stuff, and then they help introduce them to all the potential buyers and get the products to market. They sometimes get exclusive distribution rights this way.

There’d been an industry slowdown because IT kind of runs on a ~4 year “refresh cycle” where companies procure stuff periodically (usually when profitability is high). We’re waiting on the cycle to turn and revert back to ~5% through-cycle growth. This is a high-return-on-capital business that does 5-6% growth, and where I bought the stock was a $9-10 billion company that I think can be doing $1.5 billion annually in a few years and believe is worth more like $20-25 billion. It looked like a pretty good “base hit” — just a cheap, boring business that won’t go out of style or lose its leadership position anytime soon. I.e., I’m pretty sure that (a) in 5 years, SNX will be a larger business, (b) it will still be #1 earning good scale-driven returns on capital, and (c) its customers will still generally find using it for some of their go-to-market strategy than trying to go direct-to-consultant-or-user. So we bought it.

That’s the portfolio.

Next we’ll flip you guys the work on ELV & UNH, in 2-4 parts as I described.

Chat soon,

Chris

I like your Russian accent, Chris!